Visuals

Iraq continues to solidify its position as a major force in the global energy market with several significant crude oil projects. Below is a detailed look at the key projects and developments scheduled for the coming years.

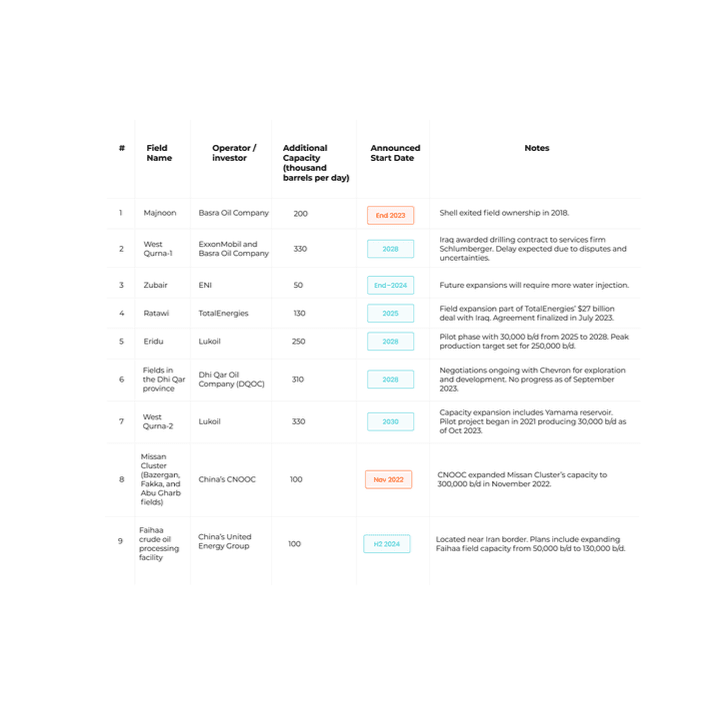

Major Projects and Capacity Expansions:

- Majnoon Field

- Operator/Investor: Basra Oil Company

- Additional Capacity: 200 thousand barrels per day (b/d)

- Announced Start Date: End 2023

- Notes: Shell exited field ownership in 2018.

- West Qurna-1 Field

- Operator/Investor: ExxonMobil and Basra Oil Company

- Additional Capacity: 330 thousand b/d

- Announced Start Date: 2028

- Notes: Iraq awarded a drilling contract to Schlumberger, but delays are expected due to disputes and uncertainties.

- Zubair Field

- Operator/Investor: ENI

- Additional Capacity: 50 thousand b/d

- Announced Start Date: End 2024

- Notes: Future expansions will require more water injection.

- Ratawi Field

- Operator/Investor: TotalEnergies

- Additional Capacity: 130 thousand b/d

- Announced Start Date: 2025

- Notes: Field expansion is part of TotalEnergies' $27 billion deal with Iraq, finalized in July 2023.

- Eridu Field

- Operator/Investor: Lukoil

- Additional Capacity: 250 thousand b/d

- Announced Start Date: 2028

- Notes: Pilot phase will produce 30,000 b/d from 2025 to 2028, with peak production target set for 250,000 b/d.

- Fields in Dhi Qar Province

- Operator/Investor: Dhi Qar Oil Company (DQOC)

- Additional Capacity: 310 thousand b/d

- Announced Start Date: 2028

- Notes: Ongoing negotiations with Chevron for exploration and development. No progress as of September 2023.

- West Qurna-2 Field

- Operator/Investor: Lukoil

- Additional Capacity: 330 thousand b/d

- Announced Start Date: 2030

- Notes: Capacity expansion includes Yamama reservoir. Pilot project began in 2021, producing 30,000 b/d as of October 2023.

- Missan Cluster (Bazergan, Fakka, and Abu Gharb Fields)

- Operator/Investor: China’s CNOOC

- Additional Capacity: 100 thousand b/d

- Announced Start Date: November 2022

- Notes: CNOOC expanded the Missan Cluster’s capacity to 300,000 b/d in November 2022.

- Faihaa Crude Oil Processing Facility

- Operator/Investor: China’s United Energy Group

- Additional Capacity: 100 thousand b/d

- Announced Start Date: H2 2024

- Notes: Located near the Iran border, plans include expanding Faihaa field capacity from 50,000 b/d to 130,000 b/d.

Economic Impact and Future Prospects

The planned expansions and developments in Iraq's oil fields underscore the country's critical role in the global energy market. These projects not only aim to increase production capacity but also address technological and logistical challenges, such as water injection requirements and the integration of advanced drilling techniques.

Challenges and Considerations

While these projects present significant opportunities, they also come with challenges, including political instability, regulatory delays, and the need for substantial infrastructure investments. The ongoing negotiations and potential delays highlight the complex landscape in which Iraq operates.

Conclusion

Iraq's ambitious plans to expand its crude oil production capacity reflect its commitment to maintaining and enhancing its position in the global energy market. By overcoming existing challenges and successfully executing these projects, Iraq can ensure sustained economic growth and stability, reinforcing its pivotal role in the global energy sector.

Sources

- Middle East Economic Survey

- FACTS Global Energy Services

- Rystad Energy

- Al Arabiya News

- Company Websites

Iraq stands as a pivotal player in the global energy market, underpinned by its vast oil reserves and significant production capabilities. With confirmed oil reserves ranking fifth globally at 145 billion barrels, Iraq's influence on global energy dynamics is substantial.

Major Oil Reserves and Production

Iraq is a key member of the Organization of the Petroleum Exporting Countries (OPEC), ranking second in crude oil production within the organization, only behind Saudi Arabia. On a global scale, Iraq stands sixth in the total production of petroleum liquids. The country's major oil fields are primarily located in regions such as Basra, Diyala, and Kirkuk, which are critical hubs for its oil extraction and export activities.

Economic Dependency on Oil Exports

The Iraqi economy is heavily reliant on oil exports, which constitute about 95% of its revenue. In 2022, Iraq's oil export revenue soared to $131 billion, up from $92 billion in the previous year. This significant increase underscores the centrality of oil to Iraq's economic health and its role in the global energy market.

Political and Legislative Landscape

Despite forming a consensus government after the parliamentary elections in 2021, Iraq faces challenges in the timely enactment of legislation and budget approvals. These delays can hinder major energy projects and impact the country's ability to fully leverage its oil resources for economic growth and stability.

Infrastructure and Development Needs

To maximize its energy potential, Iraq must address ongoing challenges in budget approvals and infrastructure development. Enhancing infrastructure is crucial for boosting production capacity and ensuring efficient export operations. Investments in infrastructure will also help Iraq better handle the technical and logistical demands of its vast oil industry.

Global Energy Influence

Iraq's substantial oil reserves, estimated at over 140 billion barrels, position it as a key global energy player. Its ability to influence global oil prices and supply dynamics is significant, given its production capacity and export volume. As the world's energy landscape continues to evolve, Iraq's role remains crucial in maintaining the balance and stability of global oil markets.

In conclusion, Iraq's vast oil reserves and its significant role in OPEC highlight its importance in the global energy market. However, to fully harness its potential, Iraq must address legislative delays and infrastructure challenges. By overcoming these obstacles, Iraq can ensure sustained economic growth and continue to be a major force in the global energy sector.

Sources

- U.S. Energy Information Administration (EIA)

- BP Statistical Review of World Energy

The deal between Iraq and Total Energies includes several key points, with the total value amounting to 27 billion dollars. Total Energies holds a 45% share, while Basra Oil Company takes about 30%, and Qatar Energy holds 25%. The planned projects in this deal include a solar power station with a capacity of 1 gigawatt, a gas facility with a capacity of 600 million cubic feet per day, a seawater supply project, and a gas recovery project in three oil fields. The solar power station is expected to begin operations by the end of 2025, while the gas recovery project is anticipated to start in 2027.

This deal represents a significant shift in Iraq's energy sector, relying on a revenue-sharing model that allocates 65% of extraction fees to the Iraqi state and 35% to cover capital and production costs. Notably, Iraq initially requested a 40% share, but a smaller share was agreed upon. This agreement reflects efforts to enhance international cooperation in developing Iraq's energy infrastructure and providing sustainable solutions for the energy sector, contributing to national economic improvement and sustainable development.

In simple terms, from January 2015 to June 2023, the amount of crude oil supplied to Iraqi power stations changed a lot, going from 112 kb/d to 265 kb/d. Monthly numbers didn't follow a steady pattern, suggesting changes in how much power was needed, how things were run, or when maintenance happened. Because we don't have data for some months, it's harder to figure out exactly why these changes happened. But it's really important to understand what caused these ups and downs so we can manage Iraq's energy better.

Data: Between January 2015 and June 2023, crude oil was used at Iraqi power stations in thousand barrels per day (kb/d), sourced from the Joint Oil Development Initiative.

Key Points:

▪The supply of crude oil fluctuated over time.

▪Monthly variations indicated changes in needs or operations.

▪Data was missing for some months.

Trends:

▪Initially, the supply ranged from 112 kb/d to 223 kb/d.

▪Fluctuations occurred without a clear pattern.

Recent Period (Jan-22 to Jun-23):

▪The supply ranged from 100 kb/d to 265 kb/d.

▪A slight downward trend was observed.

Implications:

▪Fluctuations may be attributed to shifts in demand, maintenance, or other factors.

▪Understanding the reasons behind these fluctuations is crucial for improved management.

Over the past two years, U.S. imports of crude oil and petroleum products from Iraq have shown variability. For instance, in November 2023, imports were recorded at 5,351 Mbbl, while in September 2022, they reached 8,447 Mbbl. Looking further back, the data demonstrates significant fluctuations in monthly import volumes. For example, in April 2018, imports peaked at 25,006 Mbbl, whereas in June 2016, they were notably lower at 13,011 Mbbl.

On an annual basis, Iraq remains a significant supplier of oil to the U.S. market. In 2023, total imports from Iraq amounted to approximately 84,808 Mbbl, slightly lower than the 2019 total of 95,068 Mbbl. Despite the variability, Iraq consistently ranks among the top oil exporters to the U.S., highlighting the country's strategic importance in meeting American energy demands. Analyzing these trends helps to assess the broader dynamics of global oil markets and their implications for U.S. energy security and economic stability.